Pros and Cons of Tax Increment Financing (TIF)

Securing funding is one of the most vital parts of a building project, and when facing a gap, it’s worth exploring local, state, and federal programs. In some areas, developers and owners can take advantage of Tax Increment Financing (TIF). This regional funding method subsidizes redevelopment, infrastructure, or other community improvement projects.

We have worked on numerous TIF projects, including Plaza Towers, Park@201, and the East College Street redevelopment in Iowa City. In our experience, TIF can fill a funding gap and make a project viable, but it may not align with every owner’s goals.

This article will help you determine if TIF aligns with your project by explaining the funding method in greater detail and outlining its pros and cons.

What is Tax Increment Financing (TIF)?

Tax Increment Financing (TIF) is a local funding method in which cities use projected taxes to subsidize private projects. While both cities and counties can offer TIF, it’s usually only available in designated areas needing development or infrastructure. These areas are called “TIF districts.”

When an Authority Having Jurisdiction (AHJ) creates a TIF district, the property value within the area is established as the “base.” The difference between the base property value and its value after redevelopment is called an “increment.” Cities can use this difference to help fund building projects.

An AHJ may allocate TIF in one of two ways. First, they may offer up-front cash to fill a funding gap. After construction, the AHJ will make up their investment through the increased property taxes.

Tax rebates are the second option. With this approach, tax revenue is “frozen” for a specified period (usually 15-20 years), and the AHJ rebates the difference. By foregoing some current tax revenue, a municipality can promote projects that will generate more revenue over time.

Pros of TIF

TIF represents a public and private partnership. It helps fill funding gaps for private projects that may not otherwise see completion while encouraging development in economically vulnerable areas.

Coralville, Iowa used TIF to encourage development in the Iowa River Landing. Before redevelopment, the area was a former industrial park and a designated brownfield, but with the help of TIF, it is now home to restaurants, shops, and multifamily housing.

Similarly, Iowa City has used TIF to promote downtown development. TIF projects like Plaza Towers and Park@201 have helped bring a more diverse range of businesses and residents to the area, increasing its vitality.

Mixed-use developments have brought new businesses to downtown Iowa City.

TIF projects are known to create jobs and increase sales tax revenue, benefiting the entire community. They can also promote civic improvements.

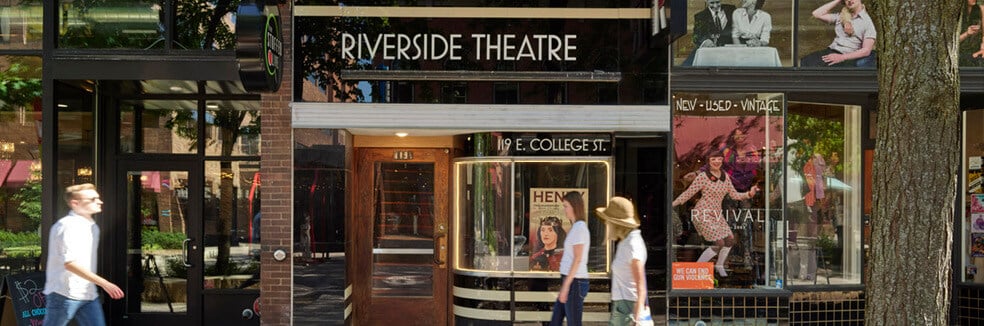

When stipulating funding, municipalities often set requirements related to sustainability, historic preservation, affordable housing, and public amenities. For example, TIF for East College Street redevelopment in Iowa City relied on renovating a historic building block and LEED Gold standards for new construction. The project also provided a new home for the Riverside Theatre, bringing an additional amenity to the area.

TIF stipulations helped create a new home for the Riverside Theatre.

Although these stipulations can add to a project’s scope, they have positive ripple effects for the surrounding community.

Cons of TIF

While TIF can help owners and developers fill funding gaps, it can increase a project’s complexity.

Requirements related to sustainability, historic preservation, affordable housing, or community amenities can potentially lengthen a project’s timeline and add to its budget. To fill a funding gap, you may need to widen it.

Developers using TIF should also prepare for financial scrutiny. The AHJ needs to ensure the project’s pro forma and projections are accurate and may hire a third-party reviewer. These reviews may lengthen the project’s timeline.

Similarly, the project may face additional public scrutiny. Any use of public funds inevitably invites critique, and some cities may even host public feedback sessions. Public feedback may impact the city’s requirements for funding.

Beyond these concerns, TIF has received criticism for contributing to gentrification. While the funding method intends to promote economic growth, new developments can potentially displace residents.

Requirements related to affordable housing or public infrastructure may offset these negative impacts. However, owners should consider if locating their project in a TIF district aligns with their goals.

Funding Methods Beyond TIF

TIF can be an effective way for owners and developers to fill a funding gap. By choosing to build in a TIF district, you can secure the funds necessary to make your project viable. Cities and counties benefit from economic development, job growth, and infrastructure improvement, and stipulations help ensure private development aligns with public policy goals.

Although TIF offers many benefits, it may not align with everyone’s goals. Additional requirements and scrutiny can increase a project’s scope. Owners requiring a faster timeline may wish to avoid this additional complexity.

If TIF does not align with your goals, other funding methods are available. In Iowa, owners have many options, including brownfield development tax deductions, federal historic tax credits, and programs that encourage sustainable design. Learn more by reading about the funding opportunities available to Iowa building owners.